Russia Ukraine Update

Russia Ukraine Event Update

On 21 February, Russia asserted its view on the independence of the Donetsk People’s Republic and the Luhansk People’s Republic. Russia began mobilising troops to conduct peacekeeping operations. This was a violation of Ukraine’s sovereignty and independence, the Minsk agreement, and has been widely denounced by the West. Subsequently, Russia instigated military strikes on Ukraine and has invaded. This is an initial event update on the war between Russia and Ukraine.

Russia initiates full scale military assault on Ukraine

The build-up of Russian forces on the Ukrainian border in recent weeks has been a clear indication of intent to take action. US and NATO Member nations have been providing Ukraine with military aid. This includes lethal weapons, anti-armour missiles & artillery, heavy machine guns, helicopters, small arms, ammunition, radio systems, medical equipment and spare parts. Monetary aid has been provided. US Administration has pledged aid to Ukraine of $650 million to date. UK, Danish and Dutch Governments have provided material monetary support.

Nothing has deterred Russia from invading Ukraine with missile strikes and border crossings. Russia seized key strategic assets including Chernobyl Nuclear plant and attacked military and civilian sites.

US and EU Member State Sanction Reactions

Post the initial move on Ukraine, sanctions were imposed. Post the missile strikes, further sanctions have now been imposed by US and other countries. Further sanctions and action may be taken.

US has sanctioned Russia’s foreign debt, meaning it can no longer raise money from Western financial institutions. This will impact Russia’s ability to finance military efforts. Further sanctions are likely as Russia deepens its invasion of Ukraine. All 27 EU Member states have agreed on a range of anti-Russia measures. Russian banks have had assets frozen in the UK. Certain wealthy Russian billionaires have been issued travel bans. Their ability to access funds from EU banks has been denied. Further, trade between EU and two rebel-held regions has been banned.

Germany has halted major infrastructure projects, including Nord Stream 2 gas pipeline,. Additionally, 351 members of Russia’s Duma, or parliamentary lower house have been hit with restrictions. Further restrictions may be imposed excluding Russia from global financial messaging service Swift, used by most banks worldwide. That would seriously curtail Russia’s ability to do business.

At some point, further sanctions would start to harm the economies of those imposing them. Countries such as the US and Germany have strong ties with Russia via trade.

Macroeconomic Impacts

Ukraine is the second largest country in Europe and a huge source of agriculture. The economic damage could have worldwide implications. Russia has inflicted economic damage on Ukraine, with contracts being cancelled and businesses withdrawing people. The White House has warned US silicon chip industry prepare for a ban of exports to Russia. This may well soon extend to all electronics supplies.

Crude Oil WTI has risen about $3 USD/Bbl today or about 3.33%, continuing recent increases.

Source: Iress

Prolonged conflict is almost certain to put further upward pressure on oil and natural gas prices. Sanctions will continue to limit supplies and force prices higher. This is particularly true in Europe, which is already struggling with high energy prices and limited supply. This may mean sustained or higher inflation, which could mean further upward pressure on interest rates.

Gold is usually seen as a safe haven in times of conflict. Main Ukraine exports are raw materials iron, steel, mining products and agricultural products, chemical products and machinery. Ukraine is a large exporter of grains and cereals so there is potential for significant price rises. The US is a large purchaser.

Equity Market and Sector Impacts

The Russian move into Ukraine will cause further increases in equity market volatility. We will continue to feel the impact in rising energy prices. As can be seen from the graphic below, Russia and Ukraine account for a material amount of Oil and gas products. They share a total around 22% of global exports combined.

Russian gas exports to Europe account for 40-50% of its import needs. Energy markets have been tight as COVID related lockdowns have abated and travel resumes. Overlay this with increasing concerns around ESG and banks in western economies under pressure to cease funding fossil fuel projects. This further underpinned already tight supply demand dynamics. We suspect there is already a premium in energy prices for current tensions. There is more upside in prices likely should full scale war break out. This feeds inflationary concerns which are already a dominant theme in equity markets. Most companies in current reporting season cite rising cost pressures in materials and labour.

Soft Commodities

Soft commodities like wheat and corn would be impacted given Russia and Ukraine account for 25% of global exports. This could potentially be an export boost for Australia if supply is restricted or sanctions placed on exports from Russia. Not included in this graphic is ammonium nitrate. Russia is responsible for around 65% of global production. This is the primary ingredient used in fertilisers. Russia banned the export of this mineral product recently, with the ban to extend to April 2022. Should sanctions remain in place for an extended period, the impact of inflation on food prices could be enduring.

Gold

During times of heightened geopolitical tension gold and gold stocks tend to be a safe haven. Gold has been out of favour as risk aversion has been low and sentiment poor. This has been reflected in valuation of gold stocks with many trading at significant discounts to respective valuations as measured by P/NAV. This is highlighted below with gold stocks on the left of the chart. We highlight Northern Star (ASX:NST) which was recently trading at P/NAV of 0.73x with a FCF yield of 7% in FY22. Sentiment appears to be changing as many investors seek safe haven assets.

Source: Iress

Valuation of Gold stocks on the left side of the chart

Source: Goldman Sachs Oct 21

Asset Class Impacts Since the Russian Move into Ukraine

Commodities

Both Oil and Gold have rallied in recent weeks, with the specter of reduced oil supply driving prices higher. Gold has performed its traditional role in periods of market stress, Investors seek protection via the precious metal.

Source: Iress

Source: Iress

Interest Rates

Have been largely driven by inflation and market expectations of rate hikes over the next 12 months. US Bonds saw some buying. Investors shifted allocations in a flight to quality given uncertainty inherent in equities markets during times of elevated uncertainty.

Equity Markets

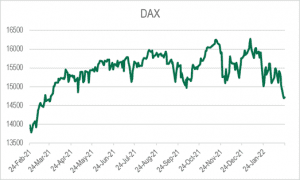

Equity Markets have been volatile for some time, with high growth stocks suffering over the past 3 months. The potential for rate hikes became clearer, however increased volatility presented by the Russian invasion of Ukraine dominated narrative since late January.

Source: Iress

German markets have seen most volatility among major European exchanges. Emerging markets have been languid over the past 12 months compared to developed market peers. Whilst the read-through impact of any conflict on Emerging Markets is likely to be varied, potential higher inflation (and consequent higher US Interest rates) is likely to be a headwind. However, the relatively higher exposure to the energy sector (6.8% in EM vs 3.8% in Developed Markets) may mitigate some volatility.

Source: Iress

Long-term implication for portfolios

It is worth noting historically, market impacts of localised geopolitical events like this have been short-lived. Diversified model portfolios are built on a Strategic (Long-Term) Asset Allocation foundations that include stress testing for geopolitical events.

We continue to monitor the situation closely as events unfold. We will continue to provide Russia Ukraine updates. Further deterioration in this conflict may necessitate the need to implement defensive portfolio changes. At this stage we are not making changes and keeping a watching brief on our Asset Class weightings. There is a fair degree of defensiveness built into current settings. The situation is deeply concerning and we will monitor closely.

From a very long-term perspective, we note that volatility has historically tended to cluster (both to the upside and downside.) See the chart below on the left. If investors react to large negative movements by selling out of equities, they run the risk of being out of the market for large positive days. The consequences of missing a handful of these “best days” can be substantial. This is evidenced by the chart below on the right. So, we are mindful of this before taking action and continue to take a long term view.

Date: 27th January 2022 Source: ASX

Author: Andrew Simpson, Andrew Ash, Ross Stanley, Steve O’Hanna. Reviewer: Matt Olsen

Footnote

This document has been prepared by Actuate Alliance Services Pty Ltd (ABN 40 083 233 925, AFSL 240959) (‘Actuate’), a member of the Insignia Financial group of companies (‘Insignia Financial Group’). This is for use and distribution by representatives and authorised representatives of Australian Financial Services Licensees with whom any Insignia Financial Group member has a commercial services agreement.

Information in this document is of a general nature only and does not take into account your objectives, financial situation or needs. You should seek personal financial, tax, legal and such other advice as necessary or appropriate before relying on the information in this document or making any financial investment, insurance or other decision.

Information in this document reflects our understanding of relevant regulatory requirements and laws etc as at the date of issue, which may be subject to change. While care has been taken in preparing this document, no liability is accepted by Actuate or any member of the Insignia Financial Group, nor their agents or employees for any loss arising from any reliance on this document.

If any financial product is referred to in this document, you should consider the relevant PDS or other disclosure material before making an investment decision in relation to that financial product.

Please don’t hesitate to reach out to the Gold Coast team of financial planners at Wealth Planning Partners to discuss your personal situation.