by Amanda Cassar | Oct 28, 2020 | Finances, Money, Wealth

From a young age we are taught…

GOOD GRADE = GOOD UNIVERSITY = GOOD JOB = GOOD MONEY

Teenagers are believing that this is the only route to lead a success.

It’s a cycle, churning throughout time – being handed down from generation to generation, merely reciting what they heard from parents and teachers in the early stages of their lives.

Are you a slave to money?

So, who has taught their children…

“If you don’t study hard and get good grades, you’ll never get a job!”

Does this sound familiar? I’m not going to lie… it’s what I was taught!

How about… “Acting like a child isn’t going to get you into a good university” We are constantly pushing our kids to strive for academic excellence so they have the best chance for success.

But, lets be honest, life can be tough and doesn’t necessarily treat you with kindness. Some people are fighting every day in order to make a living… to survive.

You see, there’s always been the division of classes: Upper, Middle, Working and Lower class

The above-mentioned terminology is globally used and seems normal to society – But in all honesty, it’s a very warped view.

Also, people are assigned into groups based on their financial circumstances and are labelled as lower, middle or upper. Naturally, the higher you are ranked the more successful you are perceived to be.

But here’s the kicker….

It doesn’t matter what class you belong to —

you always want more… What you have is NEVER enough.

Yes, even those who are ranked in the upper class! They believe that if only they could attain that little bit more money, they’d finally feel happy and fulfilled. Really? It’s never going to be enough.

Why?

It’s simple. Our infinite desire to upgrade and “level up” inflates our self-worth, makes us feel smart and gives the perception to others that we are successful. We also now have plenty of super wealthy start-up entrepreneurs who are college drop outs. But, they’ve backed themselves and done amazingly well for themselves.

If it wasn’t for this emotional reassurance, many of us wouldn’t be in debt in the first place – credit cards wouldn’t exist and retail companies would go under. A lot of us pay for houses, cars, clothes, furniture, electronics, and vacations that we can’t really afford because we are always striving to accumulate more and more. More than we currently have… More than what others have.

Ultimately, we are playing a big game with our finances.

The goal? To accumulate as much money as possible. And then? At some point in the future — it’s game over.

Richard Ashcroft is right in saying,

“We are slaves to money, and then we die.”

Wow that was very dramatic!

Ok, so let’s reel it in a bit… We don’t have to eliminate money from our lives. Money isn’t evil. Money is just… money. It’s a tool. It’s what we make of it and do with it that counts!

When handled correctly, it can be used as a powerful tool. We just have to be in control of it and understand our emotions towards it.

Be real with yourself. Ask “where do I see myself in five years from today?“

Would you like to spend less time doing the things you dislike and spend more time on the things that provide value to your life? And, if that is even possible, how the hell are you going to get there?

Firstly, take the initial step of regaining control over your spending. Stop being an easy target to retail marketing! Then, go that step further and speak with a qualified profession to go through the best solutions tailored to your circumstances. If you’d like, contact your Robina based financial adviser Amanda Cassar now. Wealth Planning Partners are Gold Coast based financial advisers, here to assist with your planning needs.

Warren Buffet sums it up beautifully with his famous quote:

It all starts with you…

the best investment you can make – is in yourself!

by Amanda Cassar | Oct 27, 2020 | Money, Relationship

Gold Coast based financial adviser Amanda Cassar says ” advisers need skills to handle financial abuse.” Could you confidently recognise a warning sign of financial abuse?

Unfortunately, financial abuse is becoming increasingly more visible on a global scale. It does not discriminate. This type of abuse can occur irrespective of someone’s economic status, level of education, race, gender or ethnicity. It’s important advisors are armed with the particular skillset required to handle cases of financial abuse. Advisers need a different set of skills in their toolkit to handle the rising global cases of financial abuse.

My road to specialising in Financial Abuse

When writing her book, Financial Secrets Revealed, the intention was to explore relationships with money. Cassar wanted to determine whether the lessons we learn in childhood impact decisions we make as adults. Our relationship money can change later in life.

Tanya Targett was one of those interviewed for the book. Targett explained how she had walked into her marriage as a savvy media professional. She was an award-winning journalist, had money in the bank, a home and a trust account. Fast forward a few years, she left the marriage with her daughter. having stashed $20 gift cards to fund groceries. She had a stroke and emotional breakdown after crawling away from her marriage. Tanya was a victim of financial abuse.

But that interview set Cassar on a path of wanting to understand the intricacies of financial abuse. Just how prevalent is it in society and what are the different forms it can take? It was hard to believe as a financial adviser, she had never come across something like this. After a lot of research, it was very apparent advisers fell into two camps. They had either experienced financial abuse first hand with a client or they had had no exposure to it at all.

What is the trigger for financial abuse?

Often there isn’t one defining moment or trigger which leads to financial abuse. It’s more of a ‘frog in the pot’ situation. The pressure is turned up slowly over time and quite often it’s a build up of little moments. And, It is often accompanied by emotional abuse and even domestic violence.

Warning signs of financial abuse

Limiting a partner’s employment options or prohibiting them from progressing is a classic red flag. Some forbid work, or any kind of study or professional development. Targett stated her husband told her to give up the ‘nonsense’ of her successful media career and take a shelf packing job.

Other warning signs can include extreme monitoring of purchases. A spouse may demand to see a receipt for every cent their partner spends or will give a controlled allowance. They likely control and monitor all bank accounts as well. Basically, any severe forms of financial control should raise an immediate flag.

As advisors, one of the first time we ever encounter suspected financial abuse could be in a meeting with a prospect, or long-term client. What if one day, your elderly client walks into your office with their adult child who is requesting all funds be withdrawn. What would you do?

If we look at elder financial abuse, thefts of funds is a big warning sign. It can taking money from the bedside table or large withdrawals from bank accounts. “Inheritance impatience” is another warning sign. Adult children may justify, “well I’m going to get it anyway, I might as well take it now”.

Action steps advisors can take

First and foremost, make sure you are protected by taking down very thorough file notes. Sometimes, it may be nothing more than a gut feeling but over time, if you’ve built up a lot of gut feelings (and file notes), it could be time to have a conversation with the person or couple in which you suspect financial abuse. Or if you’re still unsure, contact a local hotline for direction.

Setting the expectation with couples you work with by explaining you like to work with couples who have a respectful relationship. Explain what a this looks like. A relationship where both parties have the opportunity to voice their opinion, get involved in decision making and have access accounts.

Getting your licensee involved and working closely with them if you have a case that needs to be referred. Hopefully your licensee has a professional standard team and a procedure in place to handle suspected financial abuse. If they don’t, tell them they need to write one. They should have policies and procedures in place to protect you and your business.

Having a list of people you can call. Keep a list of local shelters, the elder abuse hotline, organisations like WIRE in your local state or territory. While not all of these providers will be able to solve the problem, they can point you in the right direction.

It’s not easy calling out financial abuse

It takes a very brave person to call out suspected financial abuse. If you do have a hunch something is going on, you don’t have to deal with it all on your own. Get the right people involved to support you and the victim. Do you feel that you could easily spot and signs? And feel confident that you have the skills to assist?

Cassar believe it’s also very important to make sure your entire team is on board. Make them aware of the warning signs of financial abuse. Your team are often your frontline staff. Making sure they have the confidence to speak up if they suspect untoward activity. What would they do if an adult child popping by reception with a withdrawal form for their parent? They too can be the difference between stopping financial abuse, or unknowingly supporting it.

Finally, don’t think this only happens to certain demographics of people. So, celebrities and professionals are just as susceptible. See the examples of Britney Spears, Mickey Rooney and Tina Turner.

Because advisers are in a powerful but confronting position, they need to not just recognise financial abuse. And, advisers need skills to handle financial abuse. It’s a very delicate topic, but when approached with support and conviction, could save a marriage.

For advisers who would like to learn more about recognising the signs of financial abuse, Amanda has collaborated with Standards International. Together with this UK based firm they have brought the Financial Abuse Specialist accreditation to market.

by Amanda Cassar | Oct 26, 2020 | Australian Economy, Economy, Finances, Financial Stress, Money, Wealth

How do you save for a house after being hit by the fallout from COVID? Have you been struggling financially with the COVID-19 pandemic? Has the global pandemic affected your income? How’s you financial stress level, not only in your household, but your overall mental health? If so, how can you get back on track after being hit by CoVid?

The markets took a major hit but now it is starting to stabilise as restrictions loosen. It’s never been better timing to look at your financial position.

When is a good time to start saving for a house?

You might say… “But I’m late bloomer when it comes to finances?”

To everyone who is asking the same question, know that you’re not alone. How can you save for a house? We’ve had clients in their 30’s who’s been focusing on saving for home and to be honest, it’s been rough. We’ve heard stories of journey’s full of pitfalls, late-night tears and anxiety. Lamenting and wishing they’d saved more in earlier years.

Despite tumultuous changes in the market, it’s important to find balance. There’s been remarkable shifts not only how people view their personal finances but also how they view money. Have you heard of the ‘money mindset?’

This article isn’t written to make you feel bad about being a late bloomer. It happens, but this time in history is proving to be tricky to navigate when it comes to financial independence and security. Many have utilised this period of time to review their goals. Here’s some lessons learned when finding their feet and getting those house keys. It’s time to fight back after being hit by COVID.

What not to do!

DO NOT put investments on a credit card. In fact, if you can, avoid a credit card altogether, do it.

The idea of a credit card to spend on the things we can’t afford can be tempting. Making sure you understand the risks before you get a card is vital. But what happens when you’re trapped into paying one off? It makes sense that if what you earn goes onto paying off these high-interest rates you will sink deeper into debt regardless. The best thing to do is assess what you have and then see if you can afford paying this debt off even if you did have a home loan. If your priority is saving for a house, then the other items will seem less appealing.

What to do?

Pay off your debt slowly – even if it’s over time. JUST MAKE SURE IT GETS PAID!

Student loans, credit card debts, car loans seem pretty good at the time we borrow the money. But remember that after some time, they actually gain interest. Paying off debt before you buy a house is a little tricky, but not entirely impossible. Implementing automatic direct debit payments will help you pay it on time, every time. And you’ll avoid late fees. Paying off over time is fine, but making sure you do this as quickly as possible is priority! Ask if saving for a house if your biggest priority.

Learn Patience…

Everyone wants everything now but goals take time… be patient!

Our generation struggles with patience. They want everything right now, from iPhones to houses. We decide to risk all of it for what we want. Stop and think,” have I the income to support everything that is coming out of our bank account?” Asking yourself the question of not only “can I afford it” but “can I save 10% on top of” will allow you to stop and think before you buy and invest in something new. Ensuring you have clear goals for your financial plan will put your mind at ease. Taking these measures can assure ways to increase your finances and where to invest. Take time to contribute and invest in your superannuation fund and don’t spend so easily when you have the money available.

If you are going to buy a house, know all of the pros and cons.

Home loans and investment properties can be frustrating at first glance. You need to know how much you have saved for the portion of your investment as well as the 10-20% saved before you make the purchase. Savings, purchase costs and home loans can be a balancing act and it pays to speak to someone who understands not only the market but how much financially you may need to reach your goal.

Seek the advice of a qualified Financial Advisor

Finding a financial planner to work with is important. They not only help you with your financial mindset but also look at your roadmap of how, what, when, where and why on all areas of investment. And even right up to retirement. Understanding the broader picture will help to move forward and succeed with your specific goals.

Everyone has different journey’s and pathways to travel. But, if you can invest in the bigger things earlier whilst increasing your savings you will be better off further down the track. Is it time you started saving for house now?

So, if you are a ‘late bloomer’ it’s ok, we can help you plan for your future with a view to getting you where you need to be. To meet with your Gold Coast financial planners, Amanda Cassar and Mitch Cassar, reach out. To schedule an online appointment, click here.

by Amanda Cassar | Oct 22, 2020 | Finances, Money, Savings, Wealth

Are you teaching your kids how to manage their money? Teaching our children about money is vital. Do you know how to teach your kids to manage money?

When interviewing for her book “Financial Secrets Revealed,” Amanda Cassar found most of us haven’t been taught how to manage money by their parents. Are you self taught? And what do you intend to teach your kids about managing money? It’s a question worthy of thought.

Times have changed

So, with technology come change. Can you think of the last time your children purchased something using cash? Or saw you use cash? Apple, GooglePay and pay later schemes have given us multiple options to choose from. It has made handing over cash a thing of the past.

With contactless payments becoming increasingly popular, many parents are struggling to help children understand the real value of money.

How do you teach your kids to manage money?

So, start by setting an example and putting thoughtful consideration on what you do and say about money in your home. Amanda explains “our children are sponges, so we need to be careful about how we speak. Be mindful of the messages they receive about money”. Are you teaching your children to manage money? And manage it well.

And, how your children perceive managing money all depends on how and how often you talk about money. Do you give the perception that managing money is difficult? Do you make it private or secretive; easy or burdensome, or associated with negative emotion? Most people have heard the expressions “Money doesn’t grow on trees, it takes money to make money.” As parents are we building a scarcity mindset or one of abundance? Our choices and words matter.

Because, being transparent about finances can help turn negativity into less daunting subject. And, be sure to show how it can be successfully managed and have value.

Emotions and money

And, you can help your kids understand the emotion around money. Explain the psychological aspect of why they want to spend. Explain hurdles and obstacles they will face in life. Start with something as easy like getting caught up in FOMO (fear of missing out.) Understand the urge to spend to keep up with their friends. Keeping up with the latest trends or what everyone is buying to maintain their image is a trap. Ask for their perspective.

And know, these pressures can be really hard control emotionally. But, it’s important our children are given the tools to understand why they want to purchase something. And whether the item or memory will hold value for them.

And finally, teach your children to make smart, practical choices with how they spend their money. Show them how to implement a thought process when making purchases. Teach them to stop, pause and think about why they want to purchase an item. Ask the question “Is it worth exchanging this money for this item? Or should I save it and use it for something else?”

Learning to make conscious choices is a really important tool to help children value money, especially if they can’t count it in their hands like cash.

So, for more ideas or assistance, reach out to your Robina financial advisers, Amanda Cassar and Mitchell Cassar at Wealth Planning Partners on the Gold Coast.

by Amanda Cassar | Oct 12, 2020 | Finances, General, Insurance & Protection, Money

Get ready for storm season!

The Queensland Government want everyone to Get Ready for disaster season. Use the 3 Step “Get Ready” Plan.

Prepare your household this storm season by completing these 3 simple steps:

- Have a plan Firstly, ensure your family is equipped with an emergency and evacuation plan. Make sure everyone knows what to do in a disaster. Team-up with your neighbours for added assistance if required. The Queensland government have put together a Household Emergency and Evacuation Plan form.

- Pack Supplies Secondly, have an emergency kit ready to go. A stocked “Go Bag” will ensure you are ready for storm season. This provides easy access to essential items that will equip your household for at least 3 days of isolation. Your kit should be in a sturdy waterproof

storage container. Make sure it is stored in a safe, easily accessible place within your home. And, ensure it is childproof if necessary. Be sure to let everyone know the kit’s location and document it in your emergency plan.

storage container. Make sure it is stored in a safe, easily accessible place within your home. And, ensure it is childproof if necessary. Be sure to let everyone know the kit’s location and document it in your emergency plan.

Please click here for a list of what to include.

- Make sure you’re covered Finally, the importance of having home and contents insurance cover is paramount. Many have found out too late that they did not have adequate insurance cover. Queensland has been impacted by over 70 significant natural disasters since 2011!

And, Step 3 is to make sure your insurance is enough to cover the costs of rebuilding your home and or replacing your possessions. For instance, both home owners and renters should check policies to ensure they are fully aware of what is covered.

What to ask your Insurer…

So, in conclusion, some questions to ask your insurance provider are:

- What disasters does the policy cover?

- How do they define each disaster?

- How much will the policy cover?

- Does the policy provide enough insurance to cover the cost of rebuilding your house and any extra costs you might incur?

- Is your insurance adequate to cover the replacement of your possessions?

- Are your possessions covered for damage caused by potential local hazards, such as storm, cyclone, flood and bushfire?

- In what circumstances will the insurer reject the claim?

- Are you covered for the cost of temporary accommodation if your home is uninhabitable?

- Does pre-existing damage caused by a previous natural disaster or lack of home maintenance impact eligibility of insurance claim payouts?

For how to Get Ready for Storm Season, visit the Qld Government website.

As a result, you’ll be ready to go in the event of any disasters. Or get in touch with the Team at Wealth Planning Partners, your Gold Coast Advisers to find out more. And ask, what do you need to do to Get Ready for Storm Season? Don’t leave it too late.

by Amanda Cassar | Oct 7, 2020 | Australian Economy, Budget

Federal Budget Update 2020 is out. See how this may affect your family.

Proposals

The Federal Budget Update 2020 is out, and is all about jobs, and spending to make more jobs. We already have JobSeeker and JobKeeper, and now we have JobMaker and JobTrainer.

The announcements in this update are proposals unless stated otherwise. These proposals need to successfully pass through Parliament before becoming law and may be subject to change during this process.

Announcements…

Each announcement the Treasurer made was translated into jobs. Tax cuts for 11 million taxpayers equals 50,000 new jobs; expanding the instant asset write-off and the carry back of current losses is another 50,000 jobs. Bringing forward the Stage 2 personal income tax cuts were the order of the day, and there will be no increases in tax in order to pay for spending. So unlike other economic downturns, there will be no deficits tax on high income earners.

One key theme throughout the Budget, is that the Government is keen to improve outcomes for young people. We know this recession has hit young people hard and many have taken early release of their super.

For more information about how the Budget may affect your family, click here.

Or contact your Gold Coast advisers at Wealth Planning Partners to see if you’re impacted. Call your Financial Planners at Robina on 07 5593 0855 to discuss further.

by Amanda Cassar | Sep 28, 2020 | Advisers, Australian Economy, Budget, Budgeting, Finances, General, Retirement, Superannuation

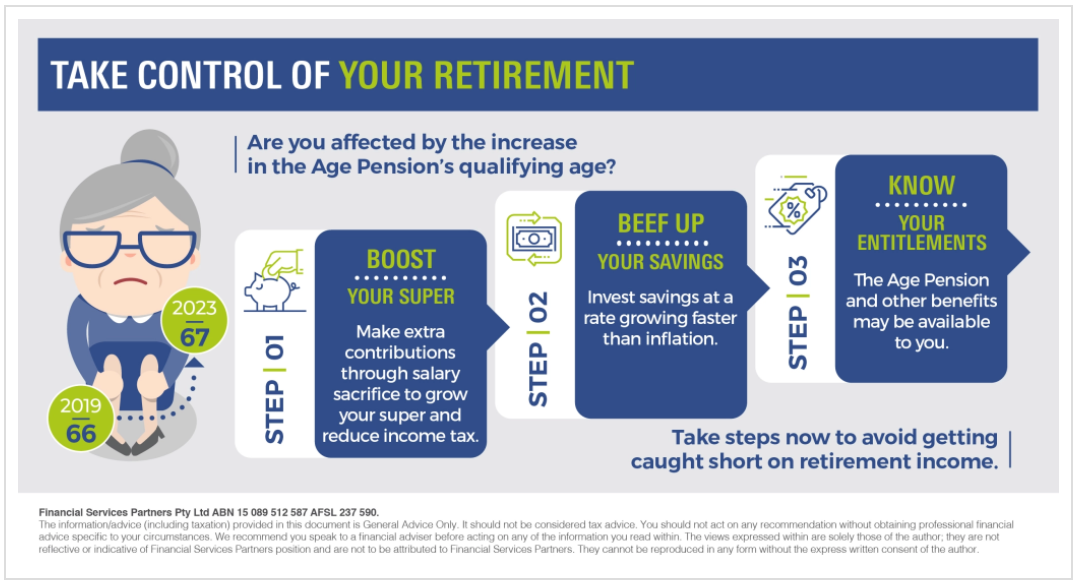

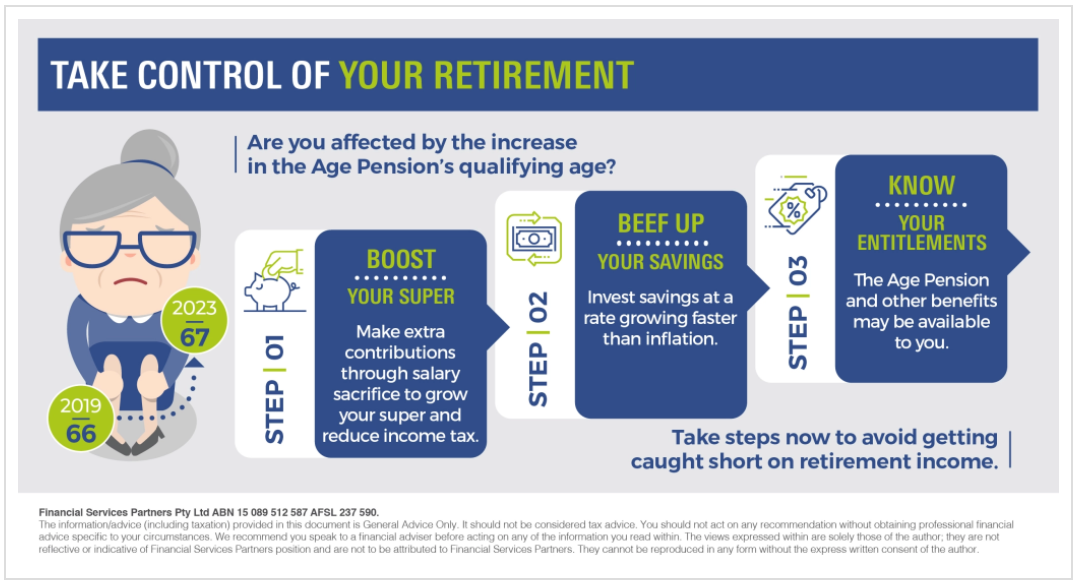

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income.

The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age increases by six months every two years until it reaches 67 in July 2023. It rises to 66 in July this year.

So, if you’re turning 45 this year and plan to retire when you reach 60, you will need to wait until 67 before you can apply for the Age Pension. You’ll have to rely on your own savings and super. This makes it crucial to ensure you have enough money put away. But, the good news is that there’s still time to grow your retirement savings. So just how do you take control of your retirement savings?

Boost your super

Contributing more to your super can be a reliable route to bolstering your retirement fund. By making extra contributions through salary sacrifice, you can grow your super and at the same time reduce the amount of income tax you pay. The government will tax salary sacrificed contributions at 15 per cent. This could be much lower than your personal marginal tax rate.

Making non-concessional or after-tax contributions is another option. You can contribute up to $100,000 each financial year if your total superannuation balance is less than $1.6 million. To understand how these contributions work, it’s wise to get professional advice.

Jump onto the MoneySmart Superannuation Calculator to see how much you could have in retirement.

Beef up your savings

Your personal savings can supplement your super payments in retirement. But are they growing enough now to provide you with some income when you retire?

To build up your savings, you may have to invest part of it and make sure it’s growing faster than the rate of inflation. Investing in a managed fund or buying an investment bond may help you increase your nest egg. Seek professional advice to see if these instruments are appropriate for you.

Know your entitlements

Besides the Age Pension, you may be eligible for other government benefits and concessions. The Seniors Card, offers individuals over 60 discounts on some commercial and public services. Concessions that allow you to buy prescription medicine at a discount are also available.

But keep in mind that these benefits have strict eligibility rules. There’s also no guarantee that these entitlements will still be available by the time you retire. So take charge of your retirement today. By working with your financial adviser, you can develop a strategy that helps ensure you’ll be well provided for regardless of changes to pension policies.

If you’d like more information on how to take control of your retirement savings, reach out to the Team at Wealth Planning Partners.

by Amanda Cassar | Sep 28, 2020 | Advisers, Finances, Investments, Money, Savings, Self Managed Superannuation Funds, Superannuation

So, how do you invest your money? When deciding how to go about investing those hard earned dollars, you need to decide whether you’ll:

- do it yourself, or

- pay a financial advisor to do it for you

Both options have their pros and cons. However, you can – of course, do a bit of both.

Buy, sell or invest yourself

The advantage of choosing to invest yourself is that you’re in control of all the decisions. It will also save you money by making it cheaper than paying a financial advisor to invest your money. The down-side risk is that you may overrate your expertise and may not diversify.

If you choose to invest directly, it’s important to have a thorough plan and put in the time to research your investments. You should also keep track of how they’re performing.

Use a professional investment manager

If you decide to invest in a managed fund, some managed accounts, exchange-traded fund (ETF) or a listed investment company (LIC) your money is pooled with other investors. A professional investment manager then buys and sells investments on your behalf.

When using a professional, you benefit from their skills and expertise to make investment decisions. However, have to pay fees for this service. These can include management fees, administration fees and entry and exit fees.

See managed funds and ETFs to learn more about these investments.

Investing with a financial adviser

Seeking a financial adviser can assist you further by setting your financial goals, understand your risk tolerance and find the right investments that are suitable to you and your circumstances.

Make sure your financial adviser has an Australian financial services (AFS) licence or is an authorised representative. Check their qualifications on the Financial Advisers Register.

- Decide what it is that you want from the advice. Would you like help with investing money, budgeting or planning for retirement?

- Ensure that you read your adviser’s Financial Services Guide (FSG) to learn about their fees and services, and how they deal with complaints.

- Do your due diligence by comparing the fees charged by different advisers, to make sure you’re getting a good deal.

- Be careful about how much access your adviser has to your investment accounts.

Ensure that you talk to your adviser if you have any questions with regards to their advice and ensure that you understand their explanations in full.

If you’d like the Team at Wealth Planning Partners to assist, we’d be more than happy to help. Just reach out on 07 5593 0855.

by Amanda Cassar | Sep 21, 2020 | Advisers, Budgeting, Economy, Finances, Financial Stress, Investments, Retirement, Savings, Superannuation

Is it time to consider your retirement lifestyle needs?

Considering the cost of living and your expected annual retirement income, is crucial to retirement planning.

So, how do you consider your retirement needs? For the record number of Australians transitioning into retirement, the increasing cost of housing is a hindrance. Many are struggling to pay off their property before they retire, and this may lead to a few common scenarios:

- Being forced to sell the family home prior to retirement and renting or downsizing

- Continuing to pay down the mortgage on the home they live in, but leave beneficiaries with an asset that has debt owing

- Long-term renting due to lack of affordable properties on the market

- Short-term renting in different locations as a way of chasing the nomadic lifestyle dream without the financial burden of a mortgage.

And. deciding where and how you want to live can be fraught with stress. This can occur whether you’re about to retire or you’re if you’re watching your parents prepare for retirement. A recent survey by National Seniors Australia outlined that many people worry they will run out of savings and investments in retirement. Women worry more about retirement savings than men. Worrying is 65% higher in people who have less than $500,000 in savings. And at least 53% higher in people who expect their main source of income in retirement to be the Age Pension.[1]

How much money do you need to retire comfortably in Australia?

According to the Association of Superannuation Funds of Australia (ASFA), there are two broad categories of lifestyles in retirement — comfortable or modest. A comfortable retirement affords people a good car, private health insurance, dining out regularly, travel, and factors enjoyed whilst working. In a modest retirement, you may be entitled to the Age Pension, but you can only afford the basics, with occasional small luxuries.

How much do you need to live on?

There are facts and figures from industry bodies and experts, but your retirement lifestyle is unique to you. Mapping your retirement plan with a financial adviser can give you a clearer picture on what you can afford. As a benchmark, here are some widely touted figures:

- A couple of about 65 years of age – $40,194pa is needed to live modestly.

- A couple of about 65 years of age – $61,786pa is needed to live comfortably.

- For singles of about 65 years of age – $27,913pa is needed to live modestly.

- For singles of about 65 years of age – $43,787pa I needed to live comfortably.[2]

Can renting affect retirement income?

While these numbers help you understand cost of living in retirement, things become complicated if you don’t own your home. ASFA’s calculations are based on the assumption retirees will own their home before retiring. So, you don’t need need to allocate money towards mortgage or rent in the budget.

However, the Australian Bureau of Statistics (ABS) report that around 285,000 Australian households ren in retirement. While renting may afford the ability to live in a more desirable location, the cost still needs to be factored in. Therefore, the numbers provided by ASFA need to be tweaked if you are renting in retirement. And, this can blow out the figures of exactly what annual income you need to have access to.

Can you rent and afford a comfortable retirement?

Based on the ASFA’s calculations, if you retire in Sydney you would need $1,166,000 as a couple or $1,045,000 as a single. This is to afford a comfortable retirement lifestyle whilst renting. While the number may be lower for other cities and regional centres, it provides a more realistic calculation. Time to reassess exactly how much your retirement nest egg should be if you’ll be renting in retirement? Having a greater understanding of how you can structure your super funds can help you be better prepared.

As with other passive investments, ensure you’re not drawing down so much capital that your balance isn’t compounding. You need an adequate rate to provide you with enough retirement income for the rest of your life.

For example, if the average return on your super balance is 9% per year, it’s wise to drawdown 4% or less so you can maintain adequate funds. Retirement may be longer than you think? A good financial adviser can work through the calculations based on your individual circumstances, factoring home ownership or rent and any Centrelink benefits. Have you considered the retirement lifestyle you want without running out of money?

What if you don’t want to rent in retirement?

If you don’t own a home and you’re not keen on renting, there are other options. Maybe you want the freedom of living in a motor home, setting up in a modern tiny home, basing yourself in a retirement village, securing granny flat rights, or, living on a cruise ship. While these options may not be for everyone, the very nature of retirement, can give you the flexibility to live a nomadic lifestyle with a smaller carbon footprint. If you’re interested in staying in one place, a retirement village or granny flat can provide you with that lifestyle.

There is no one size fits all in retirement

When it comes to your retirement dreams and finances, your picture looks different to the next person. So, have you considered your retirement needs? If you don’t own your home, you’ll need to factor the cost of rent into your retirement planning. Be sure to ensure your nest egg and the annual income you’ll draw is enough to provide your desired retirement lifestyle. If you do own your home you won’t have to worry about the mortgage or rent. But, what about home improvements and modifications as you age?

With so many different scenarios to consider, it is wise to work through your options with your financial adviser. Reach out to the Gold Coast team of Financial Planners at Wealth Planning Partners if you’d like to discuss your individual needs.

by Amanda Cassar | Sep 21, 2020 | Advisers, Finances, Investments, Money, Savings, Superannuation

Do you know how to protect yourself against scams?

The onset of COVID has propelled social media and marketing to an all-time necessity and has resulted in increased predatory scams and virtual hacking, putting people at risk more than ever before.

Here are some suggestions…

Check to see if your email is legit by having a few checklist items that you go through. This can protect you against online scams and include:

- Avoid clicking on hyperlinks in text messages or social media posts, even if they appear to come from a trusted source.

- Never respond to any unsolicited messages or phone calls where they request personal or financial details. Press delete or hang up, no need to be polite. Scammers prey on people who are too nice to say ‘no’.

- Never provide a stranger remote access to your computer, even if they claim to be from a company such as Telstra or the NBN.

- Don’t be afraid to tell them that now isn’t a good time to talk. Do your due diligence. Go away to verify the legitimacy of a contact. Research them through an independent source such as a phone book, past bill or online search. Most companies will log the call in their computer system. So, when you ring them to verify their legitimacy, they should be able to check their records and see if anyone has called you.

- Keep personal devices and details secure by having a pin code to access and using strong passwords.

- Keep devices and computers up-to-date, with appropriate anti-virus software.

- Review your privacy and security settings on social media for both your personal and business pages.

- Use Two Factor Authentication wherever it is offered.

If you recognise suspicious behaviour, click on spam or have been scammed online, take steps to secure your account and be sure to report it.

Beware of superannuation scams

The early access to superannuation that the Government offered due to COVID opened new opportunities for deception and scams. People are attempting to steal Superannuation by offering unnecessary services whilst charging a fee. These schemes are illegal and heavy penaliies apply.

Most of these scams start by receiving an unexpected call claiming to be from a superannuation company or financial services firm.

- Never provide information about your superannuation to someone who has contacted you. This includes offers to help you access your superannuation early under the government’s new arrangements.

- Ask for the callers contact details, hang-up and then call the relevant organisation directly. Search for their details through an independent source such as a past bill or online search.

- Phone back and confirm with the agent that answers the call that they did call you with a genuine offer for assistance.

- For more information on superannuation scams visit ASIC’s MoneySmart website.

Once your checklists have been completed, be sure to share it with your family or the staff in your office. Place it somewhere visible in your home or office as a constant reminder.

If you’d like a second opinion on whether something is legitimate or a scam, reach out to your Wealth Planning Partners advisers at Robina.

storage container. Make sure it is stored in a safe, easily accessible place within your home. And, ensure it is childproof if necessary. Be sure to let everyone know the kit’s location and document it in your emergency plan.

storage container. Make sure it is stored in a safe, easily accessible place within your home. And, ensure it is childproof if necessary. Be sure to let everyone know the kit’s location and document it in your emergency plan.