by Amanda Cassar | Dec 17, 2024 | Economy, Property

Why the Gold Coast Property Market Is a Hot Topic in 2025

So, what is the future of property on the Gold Coast. The glitter strip continues to be a shining star in the Australian property market. With its stunning beaches, growing infrastructure, and thriving lifestyle appeal, it remains a prime location for investors, homeowners, and developers alike.

But as we move into 2025, the question many Gold Coasters are asking is: Is it the right time to buy, sell, or hold?

At Wealth Planning Partners, we know that property decisions are some of the biggest financial moves you’ll make. In this article, we’ll walk you through the key trends and opportunities shaping the Gold Coast property market in 2025, so you can make an informed choice with confidence.

Gold Coast Property Market Trends to Watch in 2025

1. Population Growth and Migration Are Fueling Demand

The Gold Coast remains a magnet for interstate migration, particularly from cities like Sydney and Melbourne. Recent statistics show strong population growth, driven by the lifestyle appeal and affordability compared to other major Australian cities. With continued migration expected in 2025, demand for housing—particularly family homes—will likely remain strong.

2. Infrastructure Projects Continue to Boost Property Value

Ongoing infrastructure development is a key driver of property value. Projects like the Light Rail Stage 3, the Coomera Connector, and upgrades to health and education facilities are enhancing livability and accessibility across the region. As these projects come to fruition, property values in surrounding suburbs are poised for growth. Check out Core Logic RP Data for further ideas…

Ideas for Some Key Suburbs to Watch:

- Coomera – Proximity to transport and amenities makes this a rising star.

- Pimpama – Continued development and family appeal.

- Southport – A hub for business and lifestyle.

3. Housing Supply Constraints Are Impacting Prices

While demand is increasing, housing supply remains constrained due to limited land availability and rising construction costs. This imbalance between supply and demand is likely to push property prices higher, particularly in high-demand areas.

4. Interest Rates and Their Impact

With interest rates stabilising in 2025, many investors and homeowners are finding renewed confidence in the future of property on the Gold Coast. Fixed rates remain attractive for those looking to secure long-term affordability, while property owners with existing loans may explore refinancing options to optimise their financial positions.

Should You Buy, Sell, or Hold Property in 2025?

Buy: Opportunities for First-Time Investors and Upgraders

For those considering buying property on the Gold Coast, 2025 presents strong opportunities in growth suburbs and lifestyle areas. Investors can benefit from rising rental yields, driven by increased demand and low vacancy rates.

Buying Tips:

- Focus on suburbs with upcoming infrastructure projects.

- Consider dual-income properties or homes with granny flats for added rental return.

- Lock in competitive loan rates early where possible.

Sell: A Strategic Move for Long-Term Owners

If you’ve held your property for a number of years, 2025 might be the perfect time to sell and capitalise on the market’s upward trajectory. High demand and limited supply could drive competitive buyer interest. It could be time to downsize after all!

Selling Tips:

- Invest in small improvements to boost your property’s value (e.g., fresh paint, landscaping).

- Work with local agents who understand the nuances of the Gold Coast market.

Hold: Long-Term Gains for Savvy Investors

For property owners with a strong equity position, holding may be the best strategy. Continued growth in demand, infrastructure, and lifestyle appeal ensures that property values are likely to appreciate further in the coming years.

Holding Tips:

- Review your loan structure and consider refinancing if rates are favourable.

- Focus on adding value through renovations or extensions.

- A garden tidy up, lick of paint or modernising fittings can be lower cost options for high impact.

Top Suburbs for Property Investment in 2025

If you’re wondering where to invest, here are a few standout Gold Coast suburbs worth considering:

- Nerang – Affordable homes with great transport links

- Tugun – Lifestyle appeal with proximity to the beach.

- Ormeau – Family-friendly with excellent infrastructure growth.

Key Takeaways: Making the Right Move in 2025

The future of the Gold Coast property market remains a robust investment opportunity as we head into 2025. Whether you decide to buy, sell, or hold, the key to success lies in understanding the local trends and aligning your strategy with your financial goals.

At Wealth Planning Partners, we’re here to help you navigate these decisions with clarity and confidence. Our expert team specialises in investment advice, financial planning, and wealth creation strategies tailored to your needs. Why not check out our YouTube video with our Director Amanda Cassar interviewing Alex Minter of Astute Property for more information on the future of property.

Ready to Make a Move? Let’s Talk!

If you’re considering a property decision in 2025, let’s connect. Book a consultation with the Wealth Planning Partners team today and take the next step towards building your financial future.

Contact us on 07 5593 0855 to arrange an appointment.

by Amanda Cassar | Feb 14, 2024 | Insurance & Protection, Uncategorized

It’s Valentine’s Day.

Love is in the air, and some of us are searching for that perfect gift to express our affection for those closest to us. And despite a grisly past, this day has come to be known for lovers… So just what is the ultimate gift of love this Valentine’s Day?

While chocolates and flowers are lovely, this year, consider giving a gift that transcends the ordinary. That is, the gift of protection and security. Yes, we’re talking about life insurance. The ultimate expression of love and care for your partner and family. In this post, we explore why life insurance is not just a financial product. It is a symbol of unwavering commitment and love.

5 Reasons Insurance is a Gift of Love

- Protecting Your Loved Ones: Life insurance provides a financial safety net for your loved ones in the event of your passing. It ensures that they can maintain their standard of living, pay off debts, cover funeral expenses. Also, allowing them to achieve long-term financial goals, even in your absence. By securing adequate life insurance coverage, you’re showing your commitment to protecting your family’s future. No matter what life may bring!

- Peace of Mind: One of the greatest gifts you can give your partner is peace of mind. Knowing that they and your family will be taken care of financially can alleviate stress and anxiety. This allows you both to focus on enjoying the present moments together. With life insurance in place, your loved ones can feel reassured that they have a financial cushion to rely on. This in turn gives the freedom to live without fear of financial hardship.

- Planning for the Unexpected: None of us can predict the future, but we can plan for it. Life insurance enables you to prepare for the unexpected and ensure that your loved ones are not left financially vulnerable if tragedy strikes. It provides for your spouse, supports your children’s education, and maintains your family’s lifestyle. Life insurance allows you to fulfill your responsibilities and promises, even when you’re no longer here.

- Demonstrating Long-Term Commitment: Giving the gift of life insurance is more than just a financial transaction – it’s a declaration of your long-term commitment and love. It shows that you’re thinking about your partner and family’s future. And also, that you want to continue caring for them, even beyond your lifetime. By taking proactive steps to secure their financial well-being, you’re strengthening the bond of trust and love that forms the foundation of your relationship.

- Tailored Solutions for Every Couple: Life insurance policies come in various forms and can be funded from personal or retirement savings. As a couple, you can customize your coverage to suit your unique needs, goals, and budget. Whether you’re newlyweds starting your journey together or seasoned partners planning for retirement, there’s a life insurance solution that can align with your specific circumstances. Thereby providing the protection you both deserve.

This Valentine’s Day, why not go beyond the traditional gifts and consider giving your loved one something truly meaningful – the gift of life insurance.

Ensure the future of your loved ones today

Basically, by safeguarding their financial future, you’re expressing your love and devotion in a tangible and enduring way. Yes, the ultimate gift of love this Valentine’s Day. Reach out to your Wealth Planning Partners’ adviser today to explore your life insurance options or call us on 07 5593 0855. So why not take the first step towards securing a lifetime of love and protection for those you hold dear?

Happy Valentine’s Day! Above all… don’t forget the chocolates!

by Amanda Cassar | May 8, 2023 | Australian Economy, Debt Management

by Amanda Cassar | Mar 20, 2023 | Business, Economy, US Economy

Silicon Valley Bank Failure!

*Note: This article was published in March 2023 following the Silicon Valley Bank collapse and reflects the information available at that time.

Market volatility has been elevated over the past week driven by the failure of the Silicon Valley Bank (SVB). Global banking system volatility is on the rise!

The unfolding situation in the United States could be seen as having echoes of the Global Financial Crisis (GFC) from 2008. This, combined with recent falls in Credit Suisse shares (which appear to be unrelated to US mid-tier banks), has caused jitters. This is despite SVB’s failure being the second largest in US history, when put into perspective. However, it’s assets are less than one tenth of J.P.Morgan’s, one of the major players in the US banking system.

The US Federal Deposit Insurance Corporation (FDIC) has already taken control of the SVB to navigate the collapse. They act to ensure the best interest of the financial system. Further announcements from U.S. Treasury have sought to calm the broader market of the financial system’s health. Also, to reassure the market the relevant tools are available. There will be no GFC-style bailout, nor will one be necessary.

American financial systems are considered to be well capitalised overall. According to Mark Zandi, Moody’s Chief Economist, the size of the smaller banks at risk is not likely to pose any threat to the financial system.

How it happened

• SVB has been operating in a relatively unusual manner. Instead of lending the deposits received, the Bank invested in long dated fixed interest rate bonds. This exposed the Bank’s assets to significant interest rate risk which was not sufficiently hedged.

• Given rising interest rates, the value of the bonds held to cover customer deposits have fallen significantly. The need to sell fixed interest rate securities to cover the withdrawal requests resulted in realised losses.

• Earlier in the month, a single sale resulted in a $1.8 billion loss. This led the Bank to raise capital to increase the balance sheet health. The capital raise failed, which prompted customers with deposits with the Bank to withdraw their funds. In turn, resulting in a run on the Bank.

• Within 48 hours the Bank was bankrupt with the FDIC taking control.

• The US Federal Reserve and US Government have guaranteed customer funds at SVB will be paid back in full.

• Major investment bank Credit Suisse experienced panic after the share price dramatically fell, with banking operations under pressure.

Overnight, the Swiss National Bank and the Swiss financial regulator announced support for the Bank. They announced, “Credit Suisse meets the higher capital and liquidity requirements applicable to systemically important banks.” They further confirmed they will “provide liquidity to the globally active bank if necessary.”

What to do?

Banking events like the SVB collapse remind us of the importance of diversification and long-term planning. If you’re unsure how global events influence your portfolio, personalised advice is key.

This current market volatility, while significant, does not alter our long-term views on how portfolios are positioned. It is important to manage your portfolio in line with long-term objectives, aligned to risk tolerance. Please give us a call to discuss your portfolio if you still have concerns.

by Amanda Cassar | Sep 19, 2022 | Self Managed Superannuation Funds

Time is running out to apply for a Director Identification Number (director ID)

You may have heard about the new rules which require directors of Australian companies to obtain a Director Identification Number (director ID). It is a unique 15-digit identifier that directors apply for once and keep forever.

The following provides some useful further information.

As a director of my SMSF’s corporate trustee do I need a director ID?

The new requirement to obtain a director ID applies to all directors of corporate trustees of an SMSF. This obligation also applies to any directors who may have resigned from all director roles after 31 October 2021. This applies even if you have no intention to ever be appointed as a director of an Australian or foreign company.

How long do I have before I need to get my director ID?

Individuals that were a director of any company prior to 1 November 2021 have until 30 November 2022 to get a director ID. This transitional period also applies to newly appointed directors of corporate trustees of an SMSF. This is provided they were an existing director, of a company, before 1 November 2021.

Otherwise, first time directors are now required to have a director ID before they are appointed as director of any company.

What is the fastest way to apply for a director ID?

With 30 November 2022 fast approaching, we strongly encourage all directors to apply for their director ID now. The fastest way to apply for your director ID is online at abrs.gov.au/directorID.

To access the director ID application online, you will use your myGovID to log in to ABRS (Australian Business Registry Services) online. This director ID demonstration video will show you how to apply for your director ID online.

What to do if you do not have a myGovID already?

A myGovID is different to your myGov account. Your myGov account allows you to link to and access online services provided by the ATO, Centrelink, Medicare and more. myGovID is an app that enables you to prove who you are and log-in to a range of government online services.

Don’t already have a myGovID? You will need to set this up before you can apply for your director ID online. Refer to mygovid.gov.au/setup for more information.

You will need to choose your identity strength, noting that ‘standard’ identity strength is the minimum required for a director ID.

What if I can’t set up myGovID online?

Where you are experiencing difficulties setting up your myGovID, the ATO encourages you to contact them on 13 62 50.

To speed up the phone application, please have your TFN ready as well as the information listed below, required to verify your identity.

If you’re unable apply online or over the phone, the ATO will provide you with a paper form to complete. This is the least preferred option and will require you to provide certified copies of documents to verify your identity.

Can we help you get your director ID?

You must apply for your director ID yourself, so that the ATO can verify your identity.

Verify your identity against your ATO records: once you have logged into ABRS online using myGovID, you’ll need your tax file number, residential address held by the ATO, and information from two of the following:

· bank account details (where your tax refunds or payments are made and received)

· an ATO notice of assessment

· a dividend statement

· Centrelink payment summary

· a PAYG payment summary (this is different to your income statement or your PAYG instalment activity statement).

How can we help?

Have questions or would like further information about director IDs? Please feel free to give me a call on 07 5593 0855. Or arrange a time for a meeting, so we can discuss your requirements in more detail. Although we are unable to apply for a director ID on your behalf, we would be more than happy to guide you through the process. And where possible, source documents to help you verify your identity with the ATO.

For other information, resources, and timely updates relevant to your SMSF, please refer to the SMSFA’s trustee education platform. SMSF Connect.

by Amanda Cassar | Jun 28, 2022 | Investments

Staying the Course

Heightened global markets volatility can easily trigger kneejerk reactions by panicked investors.

Widespread selling, triggered by the Russia-Ukraine crisis, has been behind recent big swings on global financial markets. This includes stock markets, commodities and currency markets.

As serious as the current events are, heightened market volatility is nothing new. The onset of the COVID-19 pandemic also triggered major falls on global markets two years ago.

In March 2020, the Australian share market dropped 35%+ over 20 trading sessions. It reached its lowest level in over a decade. Very soon after, it and other global financial markets staged a quick and very strong rebound.

By the end of 2020, share markets were back near record levels, and last year they continued to build momentum.

Investors who didn’t panic, chose to ride through all that early 2020 markets volatility. Those who have remained invested ever since, have been well rewarded with both capital and income growth over time.

In volatile market conditions, staying the course is generally the best investment strategy.

Three mistakes to avoid during a downturn

1. Failing to have a plan

Investing without a plan is an error that invites other errors. Chasing performance, market-timing, or reacting to market “noise” driven by headlines included. Temptations multiply during downturns, as investors looking to protect their portfolios seek quick fixes.

2. Fixating on losses

Market downturns are normal, and most investors will endure many of them. The number of shares you own won’t fall during a downturn unless you sell. In fact, the number will grow if you reinvest your funds’ income and capital gains distributions. And any market recovery should revive your portfolio too.

3. Overreacting or missing an opportunity

In times of falling asset prices, some investors overreact by selling riskier assets. And, then moving to government securities or cash equivalents. It’s a mistake to sell risky assets amid market volatility in the belief that you’ll know when to move your money back to those assets.

Time in the markets is what counts

Trying to time markets is virtually impossible. Just being invested in the market, and making ongoing contributions, will ensure you never miss out on long-term growth.

If you’re unsure about your current investment portfolio, call the Wealth Planning Partners Team today to discuss a strategy for you.

Source: Vanguard March 2022

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

by Amanda Cassar | Jun 27, 2022 | Economy

Volatility is Normal

The volatility that we’ve seen over the last six months, while significant, is not an unusual occurrence for a normal and healthy functioning market. Heightened volatility is an uncomfortable experience in the short- term. Equity markets and some parts of the bond markets will continue to be an important contributor to overall long-term returns.

We appreciate that the current environment looks concerning given falls in markets and likely further interest rate rises during 2022. With the possible risk of recession, however it is important to continue to stay invested. Manage your portfolio in line with your long-term objectives, aligned to your risk tolerance. We encourage investors to discuss their portfolio with their adviser to ensure that it meets their personal needs, objectives and is in line with their risk tolerance.

Key Summary Points:

- Stock and Bond Markets have fallen dramatically this week, continuing the trend since the start of 2022.

- High inflation in the U.S. was the cause – coming in at 8.6%. The highest in 40 years. This prompted the U.S. Federal Reserve to raise interest rates by 0.75%. Domestically, the RBA raised rates by 0.5%.

- The Inflation is being caused by a range of factors, including supply chain disruptions due to the COVID crisis and the war in Ukraine.

- Investors fear rising interest rates, to combat inflation, will hurt economic growth and cause a recession.

- Fear of slower economic growth has hurt the share market, which performed strongly in 2020 and 2021.

- Stocks market and Bond market falls means they are now more attractively priced.

- Take a long-term view and stay invested, with diversification, in line with your risk tolerance.

- Time in the market, is more important than timing the market.

The chart above shows the recent dramatic increases in US Inflation with the colours reflecting where the inflation has come from. Mainly from energy prices, services and food.

The COVID crisis and the war in Ukraine caused reduced supply of goods and services. Also, just after the COVID crisis, governments and central banks increased the money supply to support markets and economies. The increased money supply, meant more money bidding for the same quantity of goods, causing rising prices. This will likely continue throughout 2022, as it takes time to work through the global economy.

What’s ahead?

We expect inflation and interest rates to continue rising in 2022. This will have an effect in the short-term, slowing economic growth. We also expect inflation to reduce in 2023 and this should take pressure off the global economy. This is because supply side shocks should reduce as the world opens up.

An end to the war in Ukraine would also help the inflation situation, as supply of many key commodities would increase.

Markets have fallen substantially and are therefore more attractively priced than recent all-time highs at the end of 2021. There are asset classes that should do well in the coming periods, including floating rate Bond markets and asset classes that benefit from inflation. That is, Infrastructure and Commodities.

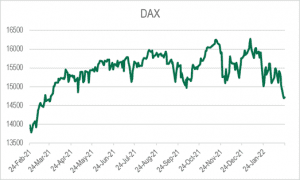

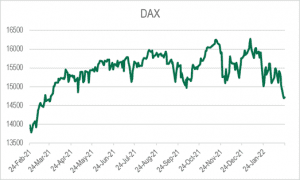

One of the important lessons in investing is that time in the market, is more important than timing the market. The following chart demonstrates that short term movements in markets (in this case the ASX 200) can be extremely volatile. This is what we have witnessed in the past six months. Investing for the longer term (the blue line) provides a much more stable outcome. As we continue working through heightened volatility, keep the longer-term in mind.

Long Term Returns (Blue Line) More Stable than Short Term Return (Green Line)

If you’re worried about your personal situation, give the Wealth Planning Partners team a call on 07 5593 0855 to chat further.

Disclaimer

The information in this report is general advice only and does not take into account the financial circumstances, needs and objectives of any particular investor. Before acting on the advice contained in this document, you should assess your own circumstances or seek advice from a financial adviser. Where applicable, you should obtain and consider a copy of the Product Disclosure Statement, prospectus or other disclosure material relevant to the financial product before making a decision to acquire a financial product. It is important to note that investments may go up and down and past performance is not an indicator of future performance.

The contents of this report should not be disclosed, in whole or in part, to any other party without the prior consent of the IOOF Research Team and Advice Licensees. To the extent permitted by the law, the IOOF Research team and Advice Licensees and their associated entities are not liable for any loss or damage arising from, or in relation to, the contents of this report.

For information regarding any potential conflicts of interest and analyst holdings; IOOF Research Team’s coverage criteria, methodology and spread of ratings; and summary information about the qualifications and experience of the IOOF Research Team please visit https://www.ioof.com.au/adviser/investment_funds/ioof_advice_research_process

by Amanda Cassar | Jun 14, 2022 | Retirement

Are you approaching retirement?

Chances are the funding of your lifestyle in retirement may be on your mind!

Take steps now to avoid getting caught short on retirement income and live the retirement lifestyle you want. It’s time to take control of your retirement.

The qualifying age is increasing by six months every two years until it reaches 67 in July 2023. The Age Pension age increased to 66 and a half on 1 July 2021.

If for example, you are planning to retire at 60 you will need to wait until you’re 67 before you can apply for the Age Pension. You’ll have to rely on your own savings and super in the interim, making it crucial to ensure you have enough money put away for later years. But the good news is that there’s still time to grow your retirement savings. Take control of your retirement savings now.

Boost your super

Contributing more to your super can be a reliable route to bolstering your retirement fund. By making extra contributions through salary sacrifice, you can grow your super and at the same time reduce the amount of income tax you pay. The government will tax your salary sacrificed contributions, within the allowable concessional contribution cap, at 15 per cent, which may be much lower than your marginal tax rate.

Making non-concessional or after-tax super contributions is another option. Generally, you can contribute up to $110,000 each financial year if your total super balance is less than $1.7 million at 30 June of the last financial year. To understand how these contributions work, it’s wise to get professional advice.

Beef up your savings

Your personal savings outside of super can supplement your super payments in retirement. But are they growing enough now to provide you with some level of income when you retire?

To build up your savings, you may have to invest part of it and make sure it’s growing faster than the rate of inflation over the long term. You should seek professional advice to see what investments are appropriate for you.

Know your entitlements

Besides the Age Pension, you may be eligible for other government benefits and concessions. For example, you may be eligible for a concession card such as the Pensioner Concession Card (if you are receiving the Age Pension), Commonwealth Seniors Health Card or the state based Seniors Card. Concession cards like these may entitle you to discounts on some commercial and public services. Concessions that allow you to buy prescription medicine at a discount may also be available.

But keep in mind that these benefits have strict eligibility rules. There’s also no guarantee that these entitlements will still be available by the time you retire. So, take charge of your retirement.

Working with your financial adviser, you can develop a strategy that helps ensure you’ll be well provided for regardless of changes to pension policies. If you’d like to discuss your own retirement needs, reach out to the team at Wealth Planning Partners to chat about your situation.

by Amanda Cassar | Feb 28, 2022 | Australian Economy, Economy

Russia Ukraine Event Update

On 21 February, Russia asserted its view on the independence of the Donetsk People’s Republic and the Luhansk People’s Republic. Russia began mobilising troops to conduct peacekeeping operations. This was a violation of Ukraine’s sovereignty and independence, the Minsk agreement, and has been widely denounced by the West. Subsequently, Russia instigated military strikes on Ukraine and has invaded. This is an initial event update on the war between Russia and Ukraine.

Russia initiates full scale military assault on Ukraine

The build-up of Russian forces on the Ukrainian border in recent weeks has been a clear indication of intent to take action. US and NATO Member nations have been providing Ukraine with military aid. This includes lethal weapons, anti-armour missiles & artillery, heavy machine guns, helicopters, small arms, ammunition, radio systems, medical equipment and spare parts. Monetary aid has been provided. US Administration has pledged aid to Ukraine of $650 million to date. UK, Danish and Dutch Governments have provided material monetary support.

Nothing has deterred Russia from invading Ukraine with missile strikes and border crossings. Russia seized key strategic assets including Chernobyl Nuclear plant and attacked military and civilian sites.

US and EU Member State Sanction Reactions

Post the initial move on Ukraine, sanctions were imposed. Post the missile strikes, further sanctions have now been imposed by US and other countries. Further sanctions and action may be taken.

US has sanctioned Russia’s foreign debt, meaning it can no longer raise money from Western financial institutions. This will impact Russia’s ability to finance military efforts. Further sanctions are likely as Russia deepens its invasion of Ukraine. All 27 EU Member states have agreed on a range of anti-Russia measures. Russian banks have had assets frozen in the UK. Certain wealthy Russian billionaires have been issued travel bans. Their ability to access funds from EU banks has been denied. Further, trade between EU and two rebel-held regions has been banned.

Germany has halted major infrastructure projects, including Nord Stream 2 gas pipeline,. Additionally, 351 members of Russia’s Duma, or parliamentary lower house have been hit with restrictions. Further restrictions may be imposed excluding Russia from global financial messaging service Swift, used by most banks worldwide. That would seriously curtail Russia’s ability to do business.

At some point, further sanctions would start to harm the economies of those imposing them. Countries such as the US and Germany have strong ties with Russia via trade.

Macroeconomic Impacts

Ukraine is the second largest country in Europe and a huge source of agriculture. The economic damage could have worldwide implications. Russia has inflicted economic damage on Ukraine, with contracts being cancelled and businesses withdrawing people. The White House has warned US silicon chip industry prepare for a ban of exports to Russia. This may well soon extend to all electronics supplies.

Crude Oil WTI has risen about $3 USD/Bbl today or about 3.33%, continuing recent increases.

Source: Iress

Prolonged conflict is almost certain to put further upward pressure on oil and natural gas prices. Sanctions will continue to limit supplies and force prices higher. This is particularly true in Europe, which is already struggling with high energy prices and limited supply. This may mean sustained or higher inflation, which could mean further upward pressure on interest rates.

Gold is usually seen as a safe haven in times of conflict. Main Ukraine exports are raw materials iron, steel, mining products and agricultural products, chemical products and machinery. Ukraine is a large exporter of grains and cereals so there is potential for significant price rises. The US is a large purchaser.

Equity Market and Sector Impacts

The Russian move into Ukraine will cause further increases in equity market volatility. We will continue to feel the impact in rising energy prices. As can be seen from the graphic below, Russia and Ukraine account for a material amount of Oil and gas products. They share a total around 22% of global exports combined.

Russian gas exports to Europe account for 40-50% of its import needs. Energy markets have been tight as COVID related lockdowns have abated and travel resumes. Overlay this with increasing concerns around ESG and banks in western economies under pressure to cease funding fossil fuel projects. This further underpinned already tight supply demand dynamics. We suspect there is already a premium in energy prices for current tensions. There is more upside in prices likely should full scale war break out. This feeds inflationary concerns which are already a dominant theme in equity markets. Most companies in current reporting season cite rising cost pressures in materials and labour.

Soft Commodities

Soft commodities like wheat and corn would be impacted given Russia and Ukraine account for 25% of global exports. This could potentially be an export boost for Australia if supply is restricted or sanctions placed on exports from Russia. Not included in this graphic is ammonium nitrate. Russia is responsible for around 65% of global production. This is the primary ingredient used in fertilisers. Russia banned the export of this mineral product recently, with the ban to extend to April 2022. Should sanctions remain in place for an extended period, the impact of inflation on food prices could be enduring.

Gold

During times of heightened geopolitical tension gold and gold stocks tend to be a safe haven. Gold has been out of favour as risk aversion has been low and sentiment poor. This has been reflected in valuation of gold stocks with many trading at significant discounts to respective valuations as measured by P/NAV. This is highlighted below with gold stocks on the left of the chart. We highlight Northern Star (ASX:NST) which was recently trading at P/NAV of 0.73x with a FCF yield of 7% in FY22. Sentiment appears to be changing as many investors seek safe haven assets.

Source: Iress

Valuation of Gold stocks on the left side of the chart

Source: Goldman Sachs Oct 21

Asset Class Impacts Since the Russian Move into Ukraine

Commodities

Both Oil and Gold have rallied in recent weeks, with the specter of reduced oil supply driving prices higher. Gold has performed its traditional role in periods of market stress, Investors seek protection via the precious metal.

Source: Iress

Source: Iress

Interest Rates

Have been largely driven by inflation and market expectations of rate hikes over the next 12 months. US Bonds saw some buying. Investors shifted allocations in a flight to quality given uncertainty inherent in equities markets during times of elevated uncertainty.

Equity Markets

Equity Markets have been volatile for some time, with high growth stocks suffering over the past 3 months. The potential for rate hikes became clearer, however increased volatility presented by the Russian invasion of Ukraine dominated narrative since late January.

Source: Iress

German markets have seen most volatility among major European exchanges. Emerging markets have been languid over the past 12 months compared to developed market peers. Whilst the read-through impact of any conflict on Emerging Markets is likely to be varied, potential higher inflation (and consequent higher US Interest rates) is likely to be a headwind. However, the relatively higher exposure to the energy sector (6.8% in EM vs 3.8% in Developed Markets) may mitigate some volatility.

Source: Iress

Long-term implication for portfolios

It is worth noting historically, market impacts of localised geopolitical events like this have been short-lived. Diversified model portfolios are built on a Strategic (Long-Term) Asset Allocation foundations that include stress testing for geopolitical events.

We continue to monitor the situation closely as events unfold. We will continue to provide Russia Ukraine updates. Further deterioration in this conflict may necessitate the need to implement defensive portfolio changes. At this stage we are not making changes and keeping a watching brief on our Asset Class weightings. There is a fair degree of defensiveness built into current settings. The situation is deeply concerning and we will monitor closely.

From a very long-term perspective, we note that volatility has historically tended to cluster (both to the upside and downside.) See the chart below on the left. If investors react to large negative movements by selling out of equities, they run the risk of being out of the market for large positive days. The consequences of missing a handful of these “best days” can be substantial. This is evidenced by the chart below on the right. So, we are mindful of this before taking action and continue to take a long term view.

Date: 27th January 2022 Source: ASX

Author: Andrew Simpson, Andrew Ash, Ross Stanley, Steve O’Hanna. Reviewer: Matt Olsen

Footnote

This document has been prepared by Actuate Alliance Services Pty Ltd (ABN 40 083 233 925, AFSL 240959) (‘Actuate’), a member of the Insignia Financial group of companies (‘Insignia Financial Group’). This is for use and distribution by representatives and authorised representatives of Australian Financial Services Licensees with whom any Insignia Financial Group member has a commercial services agreement.

Information in this document is of a general nature only and does not take into account your objectives, financial situation or needs. You should seek personal financial, tax, legal and such other advice as necessary or appropriate before relying on the information in this document or making any financial investment, insurance or other decision.

Information in this document reflects our understanding of relevant regulatory requirements and laws etc as at the date of issue, which may be subject to change. While care has been taken in preparing this document, no liability is accepted by Actuate or any member of the Insignia Financial Group, nor their agents or employees for any loss arising from any reliance on this document.

If any financial product is referred to in this document, you should consider the relevant PDS or other disclosure material before making an investment decision in relation to that financial product.

Please don’t hesitate to reach out to the Gold Coast team of financial planners at Wealth Planning Partners to discuss your personal situation.

by Amanda Cassar | Feb 25, 2022 | Australian Economy, Economy, Finances, Investments

Worried about the impact of Russian Ukraine concerns and your finances? Please reach out directly to the Wealth Planning Partners team if you want to discuss your personal financial plan.

So, a little perspective on the Ukraine and Russian situation. This geopolitical event is concerning on practically every level. And there are a wide range of potential outcomes and scenarios. Putting aside views on the way this might evolve, our role is to look at this financially and you are secure. This requires us to avoid prediction and instead use multiple layers of thought.

Want the Good News?

- Your direct exposure to Russia and Ukraine is negligible. We maintain exposure to emerging markets for some clients given the attractive valuations and diversification. Weightings to Russia and Ukraine are small. Russian companies only account for around 2.8% of the emerging market basket for equities and around 4.1% for bonds. Ukraine doesn’t register on factsheets because it is so small. Perversely, if prices in these regions fall significantly, the expected reward for buying might exceed the risk. This in turn creates a buying opportunity—but that isn’t the case right now.

- Knock-on effects? The risks are much more notable, but we do see some offsetting positives. Again, starting with the good news… tensions are pushing commodity prices higher. This has supported sentiment toward energy companies, which have done very well for portfolios lately. We carry a long term, valuation-driven focus in portfolios (preferring cheaper assets) which tend to do well in this kind of environment.. That said, we can’t rule out an exodus of investor money if things deteriorate quickly. Never expect straight lines in markets! And if negativity really takes hold, it could open a world of opportunity to add undervalued assets to your mix.

Rest assured, we are monitoring this situation closely and hearing from a range of industry experts to understand the impact as it evolves. Ultimately, we are keeping a close eye on any consequential impacts and given everything we know (while acknowledging the unknowable), it reinforces the benefits of a long-term, valuation driven approach. We’re staying in touch with the Morningstar research house to navigate this uncertain period, keeping us all on the path to achieving your goals.

What to do?

If anything changes, we’ll be sure to let you know, but for now we hope you find this touchpoint useful. In the meantime, it’s usually best to ‘hold the course.’

Please don’t hesitate to contact the Robina office or your adviser directly if you have any questions or issues. Gold Coast Financial Planners, Amanda Cassar & Mitchell Cassar are here to take your calls if needed. Contact details here.

Source: Iress

Source: Iress